can you look up a tax exempt certificate

If you claim exempt on your Form W-4 without actually being eligible anticipate a large tax bill and possible penalties after you file your tax return. It can end up costing you money if you dont know and follow the rules.

The Marvelous Texas Sales And Use Tax Exemption Certification Blank Form Within Resa Certificate Templates Letter Templates Certificate Of Achievement Template

Once you get an IRS representative on the line you can have them look up the churchs tax-exempt number.

. However you need to verify whether the non-profit has received tax-exempt status from the Internal Revenue Service IRS. Whether you sell taxable products or services and dont collect sales tax or you purchase items without paying sales tax you must know the sales and use tax consequences of your activities in each. You declare withholding allowances on your W-4 that reduces the amount of tax withheld from your paycheck.

You can ask for a review of your council tax band through the Valuation Office Agency. It is possible to ask for a review of your council tax band if you think your property has been put in a higher band than it should be for example you are paying more than your neighbours but it is the exact same size and age property. If you dont have an account enroll here.

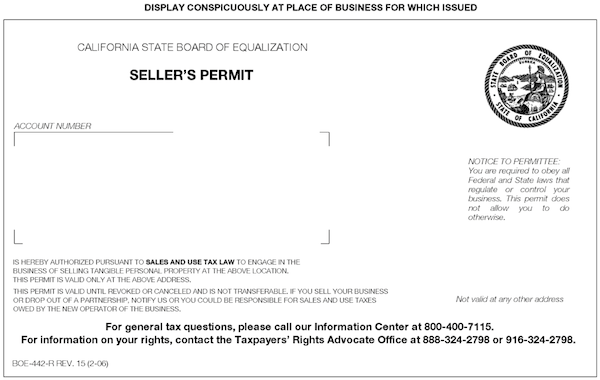

Automatic Revocation of Exemption List. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. Sales Tax Certificates Form ST-4 Your certificate must be displayed prominently at your registered location.

If both of the following statements apply you could face a tax penalty. Form 990-N e-Postcard Pub. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

To save business owners time and money the City of Fresno now offers an E-check option for paying business tax renewals. This can get tricky. But a lot can happen in three months.

The longer you wait the greater your risk of running into trouble. Churches are considered tax-exempt by the IRS without formally registering as a 501c3 and preparing an annual Form 990 return. Tax Exempt Organization Search Tool.

Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services. Call the IRS at 1-800-829-1040 if you do not have Internet access or if you prefer to speak to an operator. You could end up with incomplete andor missing exemption certificates come your next audit.

You can also search for information about an organizations tax-exempt status and filings. Many states offer sellers a grace period so you may have up to 90 days to collect a certificate after a sale. You can prepare the tax return yourself see if you qualify for free tax preparation or hire a tax professional to prepare your return.

This could save you. In the United States this status is called 501c3 after the relevant part of the Internal Revenue Code. If you need an additional or replacement copy you can print one through your Business Online Services Account.

Instead of paying a 23 convenience fee with a credit card business owners can now choose to pay with E-check with a flat fee of 089 per transaction regardless of the amount owed. For 2021 if you received an Economic Impact Payment EIP refer to your Notice 1444-C Your 2021 Economic Impact Payment. The IRS began paying the third coronavirus stimulus check also called an economic impact payment in March 2021.

Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA. To be considered a charitable tax-exempt nonprofit the organization must come under one of these categories. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

Form 990 Series Returns. The entire Form ST-28H including the direct purchase portion must be. Your local time with Alaska and Hawaii following Pacific time.

If you didnt receive the full value of your payment up to 1400 for an individual 2800 for a couple and 1400 per dependent you can receive any missing amount on your 2021 tax return by claiming the recovery rebate. Specialized software is available which can reduce audit exposure and increase productivity by centralizing exemption certificate management. Representatives are available from 7 am.

Health savings accounts are tax-exempt accounts that you use to pay or reimburse certain medical expenses if you have a high-deductible health plan. You can contribute up to 3600 per year if you have self-only coverage and 7300 if you have family coverage and deduct the amount you or someone other than your employer made to your account. Most states accept the Uniform Sales Use Tax Certificate as a reseal form but some states require special ones.

However if you choose to register with the IRS as a 501c3 by preparing Form 1023 you would then need to prepare the annual 990 return in order to maintain this status. You can also get a copy by calling Customer Services at 8043678037.

Free 10 Sample Tax Exemption Forms In Pdf

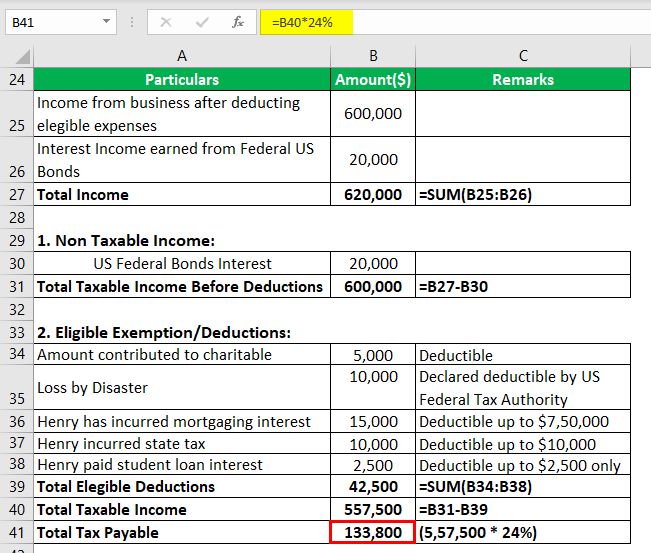

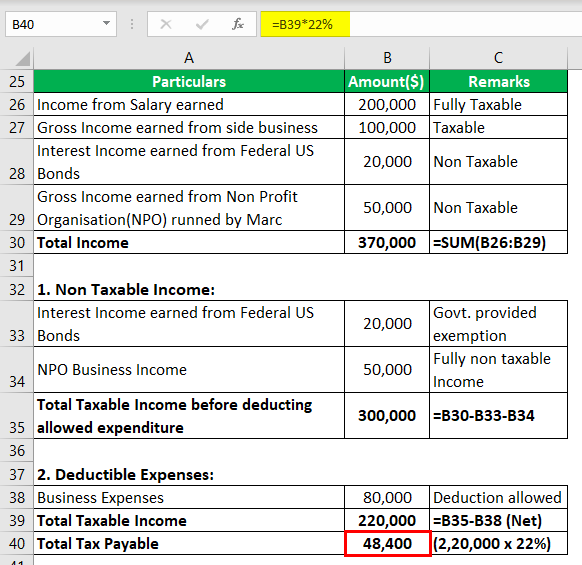

Tax Exempt Meaning Examples Organizations How It Works

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Tax Exempt Meaning Examples Organizations How It Works

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate R Letter Example Resume Template Examples Cover Letter Template

Florida Tax Exemption Forms Aviall Support Center For Best Resale Certificate Request Letter Template Letter Templates Lettering Free Gift Certificate Template

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

Tax Exempt Meaning Examples Organizations How It Works

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Resale Certificate Request Letter Template 1 Templates Example Templates Example Letter Templates Certificate Templates Lettering